The Tithe Maps and Tithe Apportionments of the mid nineteenth century provide us with a valuable research resource. The data for Cheshire is available online: https://maps.cheshireeast.gov.uk/tithemaps/

Derbyshire maps, however, require a visit to a local library where they can be viewed on microfiche.

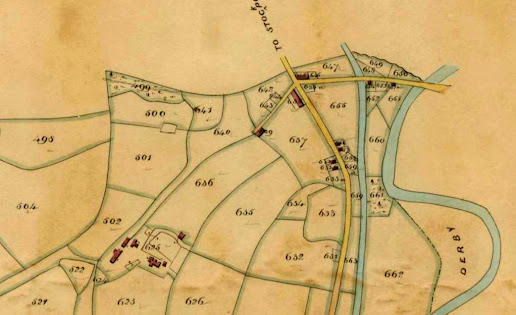

These were among the earliest large scale maps of England and Wales to be surveyed. The Cheshire maps are at a scale of 6 chains to one inch, approximately 1:4750; or 8 chains to one inch 1:6340

The maps indicate individual plots of land marked with a reference number. The Tithe Apportionment shows the historic field name for each plot, its ownership and the name of its occupier. These were often different as many farmers were tenants. The acreage of each field is given, together with its usage.

Part of the Yeardsley cum Whaley Tithe Map of 1845 including the centre of Furness Vale. Onthe left hand side, towards the bottom of the map is Yeardsley Hall and its associated barns.

The Tithe system was established in the middle-ages and was a tax on agriculture in support of the church and clergy. One tenth of all produce, originally in kind would be paid each year. Many parishes had their own "tithe Barn" where these goods were collected and stored.

There were three kinds of tithe: Predial tithes were the produce of the land such as grain and vegetables. Mixed tithes were products of husbandry including lambs, calves, wool and milk. Personal tithes were the product of labour such as fishing and milling.

Predial tithes were also known as "Great tithes" and were payable to the rector. All others were known as "Small tithes" and were paid to the parish vicar.

Hartpury Tithe Barn, Gloucestershire

At the dissolution of the monasteries in the mid 16th century, much of the church land passed into lay ownership. Rights to the "Great tithes" became personal property which could be traded. The parish vicar continued to be receive the "Small tithe" as before.

Payment in kind was gradually superceded by sums of cash. Initially fixed sums were charge although in later years these were replaced aby an annual assessment. This was formalised by the Tithe Act of 1836 which replaced tithes with a new "tithe rentcharge". The rate calculated was based upon the national price of corn.

The Tithe Apportionment was an outcome of the 1836 act and recorded, as we have seen, details of each plot of land and the amount of the rentcharge. This was a par value and varied annually. It details the tithe owner and a record of the circumstances of ownership. Common land and roadways, not subject to tithes was also recorded.

Subsequent acts in 1839, 1840, 1918 and 1925, gradually saw the replacement of tithes with redemption annuities. The Tithe Act of 1936 abolished all tithe rentcharges and replaced them with an annuity payable by the Government for 60 years. Finally, the scheme was wound up by the Finance Act of 1977.

Many parts of the country had seen protests against the tithe system.These were recorded from the early 19th century. Often dubbed "Tithe Wars", they reached an intensity in the inter-war years. At the end of World War One, many tenant farmers purchased their land, often at high prices under heavy mortgages. Resisting payment of the tithes resulted in bailiffs attempting to seize goods or even evict farmers. Resistance, often violent included a large crown in Kent burning an effigy of the Archbishop of Canterbury. A famous incident was the "battle of the ducks" at Westwell, Kent in 1934. The Ecclesiastical Commissioners seized ducks and other livestock when a farmer refused to pay the tithe. A crowd of up to 100 young men liberated the birds and returned them to their "rightful pond". Embarassed and angered by the incident, the Church sent their agents under police protection to retrieve the birds and to gather additional bounty.

Tithe protestors

The name "Tithe" originates from the Old English teogoþa, meaning "tenth". The practice of giving one tenth of ones income to a religious body is an ancient tradition and predates Christianity. Jesus is said to have advocated it and the practice continues to this day although usually of a voluntary basis.